Ask a Retirement Coach: Do I Really Need a Non-Financial Plan for Retirement

Dear Retirement Coach;

I'm getting ready to retire in the next 6 months. Everyone seems to be asking me what I am planning to do in my retirement. To be honest, I don't have any structured plans and think I'll just figure it out as it goes. Should I be concerned?

I would appreciate your thoughts.

Eric

Dear Eric,

Don’t take comfort in this, but you are right in there with the 2 out of 3 retirees that “drift” into their retirement with little or no non-financial plan.

Therefore, I will say, yes, you should be concerned.

Assuming that retirement will “take care of itself” is the same as planning to fail at maximizing your retirement experience. I’ll assume you’ve planned out the financial end and have that covered. That’s foundational and one of the keys to the success of your retirement.

However, don’t stop there. It’s vital that attention be paid to the less tangible, often-hidden parts of retirement i.e., the non-financial components: mental, physical, social, and spiritual.

I’m going to focus my suggestions to you around the four most common fears and realities that new retirees face as they move into their retirement:

Deteriorating health

Boredom

Feelings of Irrelevance

Loss of identity

Develop a plan designed to address these and your retirement has a much greater chance to be all that you could hope it to be.

Start with your health.

You won’t enjoy much of anything, let alone your retirement, if you don’t feel good. Retirees often slide into lethargy, inactivity, and experience a general, gradual decline in health.

Like most new retirees, you may be coming off of a lifestyle that didn’t prioritize healthy habits. It’s crucial to become knowledgeable about your biology and begin now to build in the healthy habits of proper diet, adequate exercise, increased social engagement, and continued learning that will sustain you through your retirement.

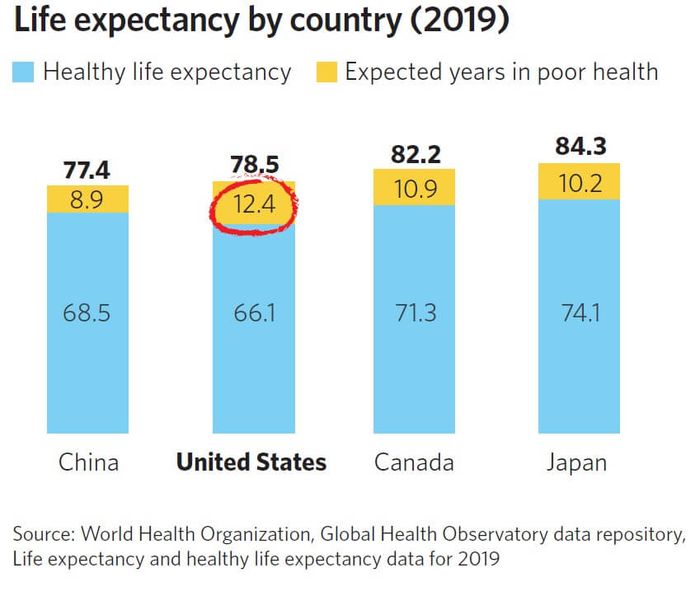

Here's an illustration of what you don’t want to happen. The average American retiree has one of the shortest lifespans compared to all other developed countries and endures an average of 12.5 years of ill health, also the highest among developed countries.

Admittedly, it’s likely that the damage behind that extended period of ill health is a result of poor lifestyle habits in the first half or two-thirds of life.

However, just know that the body has amazing recuperative powers and it’s never too late to start adopting healthy habits. Put that adoption at the front end of your retirement plan.

Have a sense of purpose.

Items 2-4 on the list are taken care of if your retirement has a purpose. Many retirements simply go FROM something but not TO something and drift into a lifestyle with no purpose. This has been identified as the number one reason that people flunk retirement.

The most common result is boredom. There is only so many times you clean the garage, play golf, visit equally bored friends or the Buddhist ruins in Thailand. At some point, the love affair with the La-Z-Boy and the voice-activate remote will fade and you’ll begin to ask yourself “Who am I” and “Why am I here?”.

Your identity and sense of relevance are in jeopardy with an unplanned, full-stop retirement. You will soon be without a title and a regular paycheck, which can be a major issue for men since we are so tied to our jobs, our titles, and being a provider.

Will you continue to work - full time, part time, volunteer, start a business?

Statistics show firmly that work of some type with a selfless component is a key component of living longer and healthier. Have a plan for maintaining a high level of social engagement.

Social isolation is a major downside of retirement and is seen as a major contributor to early death (National Institute of Aging says it’s equivalent to smoking 15 cigarettes a day).

How are you going to replace the social environment you left at work? How will you maintain your emotional and mental health? Do you have a plan for continued mental stimulation and learning? Sorry Discovery and National Geographic channel won’t get it.

Continued learning is a potential safeguard against dementia.

Read. Learn something new every day. Explore. Be curious. Challenge your brain. Your brain is like a muscle – you need to use it or lose it.

Retirement is like an iceberg - so much of what goes on is hidden until one gets into it. Advanced planning will help head off these four fears.

I’ll end with some words from Richard Leider, author, founder of Inventure – The Purpose Company and considered by many to be the foremost authority on the power of purpose:

“I’ve come to understand even better how purpose is a fundamental motivating force for all humanity. It brings a wholeness to who we are, a sense of meaning to what we do, and a deeper connection to all life around us.”

That can be your retirement if you go into it with a plan. Good luck!

Gary

Do you have any questions about the non financial aspects of retirement that you would like a Retirement Coach to answer? Send them to [email protected].

About the Author

Gary Foster is a former executive healthcare recruiter, over-70 “portfolio-career” guy, and audacious ager dedicated to helping folks in the over-50 crowd adopt a new, healthier, and more purposeful perspective on the second half of life. With national certifications as a retirement coach, résumé writer, and online presence expert plus over 18 years of career coaching and recruiting experience, he coaches, speaks, and writes publicly on the issues of mid-life career transitions, planning for purposeful retirement, and achieving better health and greater longevity. You can reach Gary through his website: Make Aging Work.